by Calculated Risk on 8/05/2008 06:50:00 PM

Tuesday, August 05, 2008

The Slowdown in China

Note: Please don't miss Tanta's post this morning on the NY Times and Freddie Mac.

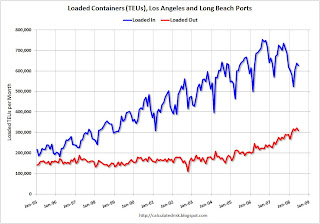

On China and trade: This first graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic grew quickly for a number of years, but appears to be declining (there is a strong seasonal component). Inbound traffic is off almost 14% from June 2007.

Outbound traffic was flat for years, but has been increasing the last few years. Outbound traffic is up 12% from June 2007.

A few key points: Imports have slowed, and U.S. exports are increasing fairly rapidly. This means the trade deficit (especially ex-petroleum) is also decreasing. This change in the trade balance is probably due to the weak dollar and the weak U.S. economy.

Trade has also boosted GDP (trade contributed 2.4% to the Q2 GDP growth), and has kept U.S. manufacturing employment from falling sharply as usually happens in a recession. This last point has been important in my forecast that headline unemployment wouldn't reach 8% in this cycle.

And from the NY Times: Booming China Suddenly Worries That a Slowdown Is Taking Hold

China's post-Olympics economic slowdown has started before the Games have even begun.

New orders at Chinese factories plunged last month. Exports are barely growing, after adjusting for inflation and currency fluctuations. The real estate market is weakening, with apartment prices sinking in southeastern China, the region hardest hit by economic troubles.

"China has slowed down a lot already, but it's going to slow down more," said Hong Liang, the senior China economist at Goldman Sachs.

...

Weak demand from the United States over the past year, and now from Europe as well, is part of China's emerging problem. On Sunday evening, the port here in Hong Kong was less full of containers than usual, part of a broader slowing of export growth.

This slowdown is reflected in the Shanghai SSE composite index that is off about 54% from the peak.

This slowdown is reflected in the Shanghai SSE composite index that is off about 54% from the peak.And this slowdown is probably impacting oil prices. And that will also help the U.S. trade deficit.

The danger is that China - and the rest of the global economy - will slow down too quickly, and U.S. exports will be negatively impacted. That could lead to more unemployment in the U.S. than I'm currently forecasting, and also a deeper recession.