by Calculated Risk on 9/04/2008 07:47:00 PM

Thursday, September 04, 2008

The Import Slowdown: Los Angeles Area Ports

This is an update to an earlier post in April. Click on graph for larger image in new window.

Click on graph for larger image in new window.

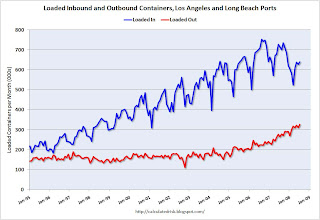

This graph shows the loaded containers per month - inbound and outbound - for the ports of Los Angeles and Long Beach combined.

Note: container traffic doesn't tell us about value, but it gives us a general idea on import and export volumes. We have to wait for the monthly trade deficit report for dollar values.

Imports have been surging for years, but import traffic started to decrease last year. For the last two month, import traffic averaged a decrease of 12.1% year-over-year.

Recently exports have picked up, and for the last two months export traffic has increased an average of 17.8% year-over-year.

Although this is just two Los Angeles area ports, this fits with the declining trade deficit (see 2nd graph). For export businesses in the U.S., these have been good times. However, as San Francisco Fed President Dr. Yellen noted this morning, the global slowdown might start to impact exports:

"[E]xport growth alone contributed one-half of the total real GDP growth registered in the second quarter. This element has been an important source of strength in our economy for over a year, being buoyed by strong growth abroad and by the weakening of the dollar. However ... in recent months the dollar has risen somewhat and economic growth in many of our industrialized trading partners has slowed or even turned negative, suggesting that we can no longer count on exports as an important source of strength."

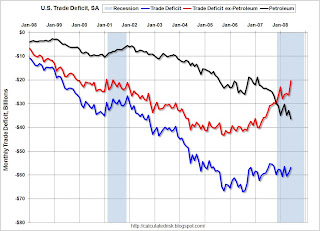

Here is a graph of the trade deficit (June is the most recent data).

Here is a graph of the trade deficit (June is the most recent data).The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit). The oil deficits in July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

The ex-petroleum deficit is already falling fairly rapidly with weak imports and strong exports.

Back in April I asked what would be the impact of slowing imports on China and on oil prices? I noted the dramatic decline in the Shanghai index:

The Shanghai SSE composite index is now below 2,277, the lowest since the amazing run up started in 2006. The index is off over 61% from the peak. This suggests a slowdown in the Chinese economy, and probably less business investment in China.

The Shanghai SSE composite index is now below 2,277, the lowest since the amazing run up started in 2006. The index is off over 61% from the peak. This suggests a slowdown in the Chinese economy, and probably less business investment in China.And the SSE index will probably fall further tonight after the 344 decline in the DOW today.

And as far as oil prices, the decline has been sharp, with prices now down by about one third from the peak. This could have serious implications for OPEC, see the NY Times: As Oil Prices Fall, OPEC Faces a Balancing Act and my speculation back in March: Petroleum Prices and GCC Spending

There is no longer any discussion of decoupling of the U.S. and world economies (something that never made sense to me). Now the questions are: Will U.S. exports continue to grow as economic growth slows or turns negative for U.S. trading partners? And will a combination of some U.S. export growth and lower oil prices provide enough of a cushion to keep the U.S. out of a severe recession? I think so, but the next several quarters will be especially ugly in the U.S. with rising unemployment, less business investment, and probably negative Personal Consumption Expenditures (PCE), or in Dr. Yellen's words "decidedly subpar" (and she wasn't discussing golf).