by Calculated Risk on 9/12/2008 09:07:00 AM

Friday, September 12, 2008

Retail Sales Decline

From the WSJ: Retail Sales Tumbled in August

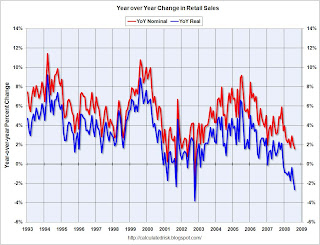

Retail sales decreased by 0.3%, the Commerce Department said Friday. ... Sales were revised sharply downward for July, decreasing 0.5%; originally, Commerce said July sales dipped 0.1%. June sales had gone up a mere 0.1%.This graph shows the year-over-year change in nominal and real retail sales since 1993.

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (August PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales increased 1.5% year-over-year (retail and food services increased 2.6%), real retail sales declined by 2.6% (on a YoY basis).

The stimulus checks appeared to help consumer spending in Q2, but Q3 is off to a very weak start. This weakness in retail sales is probably because of the weak job market and less mortgage equity withdrawal (MEW) by homeowners (the Home ATM is empty!).

Retail sales are a key portion of consumer spending and real retail sales are now indicating recession.