by Calculated Risk on 10/28/2008 10:42:00 PM

Tuesday, October 28, 2008

NY Times: Lenders Begin to Curb Credit Cards

From Eric Dash at the NY Times: As Economy Slows, Lenders Begin to Curb Credit Cards

Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5 percent of credit card debt outstanding, and could surpass the 7.9 percent level reached after the technology bubble burst in 2001.

“If unemployment continues to increase, credit card net charge-offs could exceed historical norms,” Gary L. Crittenden, Citigroup’s chief financial officer, said.

Click on graph for larger image.

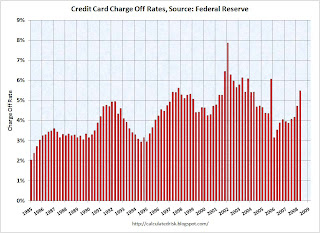

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed and a new record will probably set during this recession.

To add to the story, here is a comment from the Capital One conference call two weeks ago:

We have tightened underwriting standards across the boar. In our US card business we have gotten more conservative. We have begun to reduce credit lines. We have continued to tweak our underwriting models and to the recalibrate models this may be unstable. We have adapted our models and approaches as the economic environment has changed and we are intervening judgmentally even more than our models would indicate.No Home ATM. No credit cards. What is a debt addicted U.S. consumer to do?