by Calculated Risk on 10/21/2008 06:26:00 PM

Tuesday, October 21, 2008

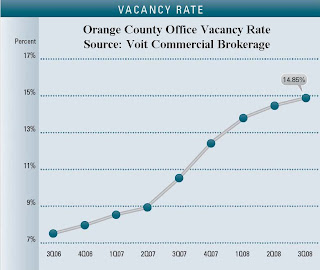

O.C. Office Vacancy Rate hits 14.85%

From Jon Lansner at the O.C. Register: O.C. office glut grows to post-9/11 slump levels

Empty office space in Orange County jumped to 14.85% this quarter up from 10.53% in the third quarter a year ago, reports Voit Commercial Brokerage.

"This increase is a result of the new construction coupled with a slowing economy, as financial markets correct,” writes Voit’s Jerry Holdner.

Still he says things aren’t as bad as they were in the first quarter of 2002, when office vacancies hit 17.2%.

Click on graph for larger image in new window.

This graph shows the quarterly Orange County office vacancy rate since Q3 2006. (See Voit report page 4 for annual vacancy rates starting in 1998).

Note: the y-axis does not start at zero.

In 2007 the rapid increase in the vacancy rate was due to a huge increase in new space combined with negative absorption as a number of Orange County financial companies (like New Century) went under. New construction has slowed, but the absorption rate is still negative as the economy is in recession.

From the Voit report:

During the first three quarters of 2008, Orange County has added just over 1.55 million square feet of new office development, most of which was in the Airport and South County submarkets. The record year for new development was 1988, when 5.7 million square feet of new space was added to Orange County, and vacancy rates were approximately 24%. We are a long way from those records.So the vacancy rate is a long way from the peak during the S&L crisis. And builders have slowed down on new construction:

Total space under construction checked in at 292,139 square feet at the end of the third quarter, which is almost 90% lower than the amount that was under construction this same time last year. It is estimated that a total of 1.7 million square feet of new construction will be completed this year, most of which has already been delivered. This will put less upward pressure on the recent rise in the vacancy rate.But even with less new construction, the vacancy rate has continued to climb due to a negative net absorption rate:

Net absorption for the county posted a negative 361,184 square feet for the third quarter of 2008, giving the office market a total of 1.37 million square feet of negative absorption for the first three quarters of this year. Last year Orange County had a total of 947,370 square feet of negative absorption. This negative absorption can be attributed to the credit crunch and finance companies consolidating.Because of the concentration of subprime lenders in Orange County, the office space market was hit earlier than other areas of the country. In response, builders cut new construction dramatically. The rest of the country should follow Orange County and I expect a significant decline in new office construction over the next 18 months based on the architects survey and tighter lending standards.