by Calculated Risk on 10/22/2008 07:41:00 PM

Wednesday, October 22, 2008

WSJ: Banks may see record credit card losses

From David Reilly at the WSJ Heard on the Street: Credit Card Losses May Scale New Peak

... A broader range of consumers now carry cards, and many run consistent credit balances to fund their lifestyles. This has led to successively higher peaks over the years in credit card charge-off rates.The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2. As Reilly notes, third quarter data hasn't been released yet, but will certainly be higher based on reports from financial institutions:

The danger is that the current financial downturn results in a new, far-higher peak charge-off rate that leads to unexpectedly large losses at banks and other card issuers.

American Express said on its earnings call Monday that its loss rate had increased to 6.1% in September, compared with 5.9% for the quarter overall, and that it expected losses to grow to the end of the year. J.P. Morgan, meanwhile, forecast that its credit card loss rate could climb to 7% by the end of 2009, compared with about 5% in the third quarter.

Click on graph for larger image.

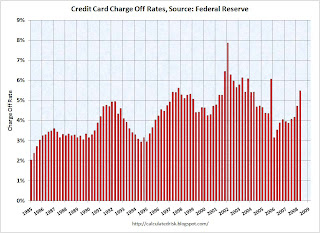

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed.

It seems reasonable to expect at or near record credit card charge-off rates during this recession.