by Calculated Risk on 11/01/2008 11:42:00 AM

Saturday, November 01, 2008

Citigroup: $1.4 Billion in Losses from Credit Card Securitization

From the Citigroup 10-Q filed with the SEC on Oct 31st (hat tip Ray):

In the third quarters of 2008 and 2007, the Company recorded net gains (losses) from securitization of credit card receivables of ($1,443) million and $169 million, and ($1,398) million and $747 million during the first nine months of 2008 and 2007, respectively.And Citigroup on Credit Reserves:

The $2.3 billion build in North America Consumer primarily reflected a weakening of leading credit indicators, including higher delinquencies on first mortgages, unsecured personal loans, credit cards and auto loans. Reserves also increased due to trends in the U.S. macroeconomic environment, including the housing market downturn and rising unemployment rates.It is more than just possible that loss rates will exceed their historical peaks during the current recession - it appears highly probable.

...

As the environment for consumer credit continues to deteriorate, the Company has taken many actions to manage risks such as tightening underwriting criteria and reducing credit lines. However, credit card losses may continue to rise well into 2009, and it is possible that the Company's loss rates may exceed their historical peaks.

emphasis added

Click on graph for larger image.

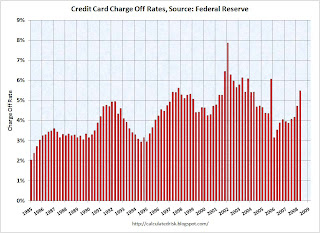

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985. The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed. Q3 data will be released soon.