by Calculated Risk on 11/24/2008 05:59:00 PM

Monday, November 24, 2008

Existing Home Sales: Turnover Will Slow

This was an important disclosure:

"The Realtors are reporting that foreclosure sales - that is distress sales being foreclosures or short sales - have risen from what they thought was 35% to 40% of all existing home sales, now they are saying it is 45% of all existing home sales. They also are saying they are seeing further softening toward the November numbers."This is another reminder that the only reason existing home sales appear to have "stabilized" is because of the high number of REO sales. Sales excluding REOs have plummeted.

CNBC's Diana Olick: Existing Home Sales

I've argued before that REO resales are real sales and should be included in the NAR statistics, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, unlike the speculators in recent years - and these investors will probably hold the properties for a number of years too.

This suggests to me that turnover will slow further.

Click on graph for larger image in new window.

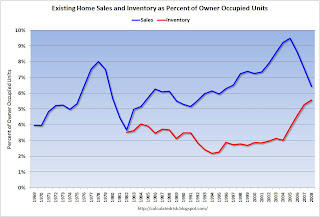

Click on graph for larger image in new window.This graph shows existing home turnover as a percent of owner occupied units. Sales for 2008 are estimated at just over 4.9 million units.

I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2008 is for October).

The turnover rate was boosted in recent years by:

Although slowing, the turnover rate is still above the median for the last 40 years and substantially above previous troughs. Both types of speculative buying are over for now. And the Baby Boomers have probably bought move up homes, and the next major move will be downsizing in retirement (still a number of years away).

And finally - and probably a very important point - homeowners with negative equity, who manage to avoid foreclosure, will be stuck in their homes for years.

All of the above suggests the turnover rate - and existing home sales - will fall further, perhaps much further.