by Calculated Risk on 11/06/2008 04:13:00 PM

Thursday, November 06, 2008

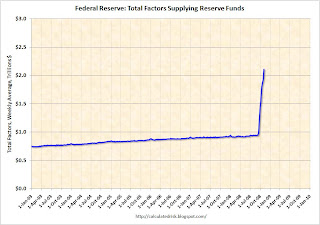

Federal Reserve Assets Increase $105 Billion

Looking a long time ahead to an economy far, far away ... I think one of the indicators of a recovery will be a shrinking Fed balance sheet. The assets on the Fed's balance sheet have doubled from under $1 trillion at the beginning of 2008 to about $2.075 trillion now.

Dallas Fed President Richard Fisher thinks there is much more to come:

"You can see the size and breadth of the Fed’s efforts to counter the collapse of the credit mechanism in our balance sheet. At the beginning of this year, the assets on the books of the Fed totaled $960 billion. Today, our assets exceed $1.9 trillion. I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."Here is the Federal Reserve report released today.

Dallas Fed President Richard W. Fisher, The Current State of the U.S. Economy and the Fed’s Response, Nov 4, 2008

Click on graph for larger image in new window.

The Federal Reserve assets increased from $105 billion this week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the graph shows Federal Reserve assets are still increasing rapidly. Fisher may be right - $3 trillion by the end of the year.

The good news is the Fed marked up the value of the Bear Stearns assets to $26,863 from $26,802 million two weeks ago - an increase of $61 million!

Update: For more, see Dr. Setser's post from last week: Two two-trillionaires

The Fed’s balance sheet just surpassed 2 trillion dollars. It has grown by a trillion dollars over the course of the year. Literally. ... That growth was financed by Treasury bill issuance ($560b from the supplementary financing facility) and a large rise in banks deposits at the Fed ($405b).