by Calculated Risk on 11/15/2008 07:01:00 PM

Saturday, November 15, 2008

NY Times: The Debt Trap

From the NY Times: Downturn Drags More People Into Bankruptcy

The number of personal bankruptcy filings jumped nearly 8 percent in October from September, after marching steadily upward for the last two years ... Filings totaled 108,595, surpassing 100,000 for the first time since a law that made it more difficult — and often twice as expensive — to file for bankruptcy took effect in 2005. That translated to an average of 4,936 bankruptcies filed each business day last month, up nearly 34 percent from October 2007.

“Earlier downturns followed strong booms, so families went into recessions with higher incomes and lower debt loads,” said Elizabeth Warren, a professor at Harvard Law School ... “But the fundamentals are off for families even before we hit the recession this time, so bankruptcy filings are likely to rise faster.”

Not surprisingly, filings are increasing most rapidly in states where real estate values skyrocketed and then crashed, including Nevada, California and Florida. In Nevada, bankruptcy filings in October were up 70 percent compared with last year. In California, bankruptcies jumped 80 percent in the same period, while Florida’s filings rose 62 percent.

Click on graph for larger image in new window.

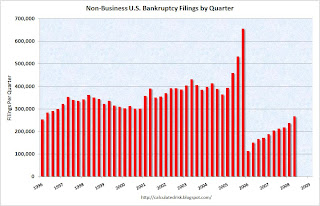

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings per quarter since the beginning of 1996 through Q2 2008 (Source: USCourts.gov). According to the NY Times article, filing were over 100 thousand in Oct 2008 and will probably be well over 300 thousand for Q4 2008 - so the graph is still trending up.

Note that there was a small surge in filings during the last recession (in 2001). As Professor Warren noted, usually household balance sheets are in pretty good shape at the end of a boom, but not this time. Instead, this time many households were struggling with too much debt even before the current recession started. So the surge in filings will probably be much larger than in 2001 (also that was a business led recession).

In addition, it is likely that some changes will be made to the bankruptcy law early next year, and it is possible we will see a record number of non-business bankruptcies in 2009 (or perhaps the 2nd highest total behind 2005 when many people rushed to beat the changes in the bankruptcy law).