by Calculated Risk on 12/14/2008 06:44:00 PM

Sunday, December 14, 2008

What if they had a Fed Meeting ...

... and no one cared?

The Fed starts a two day meeting tomorrow, and no one really cares about the Fed Funds rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Sure, the Fed will probably cut the Fed Funds rate by 50bps (maybe even 75 bps based on the probabilities from the Cleveland Fed)

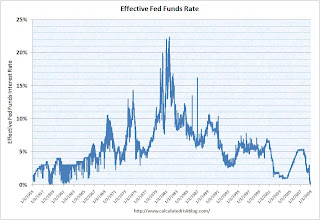

But the effective Fed Funds rate is already close to zero (0.14% as of last Thursday). The 2nd graph shows the Federal funds effective rate since 1955. The last time the rate was this low was 50 years ago.

The last time the rate was this low was 50 years ago.

But people do care about the Fed statement. Will the Fed discuss non-traditional methods and quantitative easing?

Rex Nutting at MarketWatch has more: This is what a really bad recession looks like

In a speech he gave more than six years ago, Chairman Ben Bernanke laid out all the nontraditional methods he'll be using this year and next to fight the credit squeeze and escape from the liquidity trap.Here are two of Bernanke's speeches on the topic:

The two-day meeting, Bernanke will try to get the rest of the committee formally on board with his strategy, which will be more and more focused on what's called quantitative easing.

"We look for the accompanying statement to highlight that the main nexus of policy in the coming months will be quantitative easing operations, and we expect these operations to be aimed at lowering borrowing costs for households and businesses," wrote Dean Maki, economist for Barclays Capital Management.

What exactly is "quantitative easing"? Simply put, it's an attempt by the Fed to flood the financial system with so much cash that some of it will have to be lent out. The Fed would do that by "purchasing long-term Treasuries and agency debt and possibly financing a wider range of asset-backed securities," said economists for BMO Capital Markets.

Deflation: Making Sure "It" Doesn't Happen Here, Nov 21, 2002

Conducting Monetary Policy at Very Low Short-Term Interest Rates, January 3, 2004