by Calculated Risk on 1/09/2009 02:47:00 PM

Friday, January 09, 2009

The Residential Rental Market

Yesterday I linked to an article in the Los Angeles Times about declining residential rents: Housing downturn hits L.A.-area rents

There are several different factors impacting rental supply and demand - and therefore rents - for residential properties.

First, there has been a significant shift away from homeownership: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased slightly to 67.9% in Q3 2008 (most recent data) and is now back to the levels of the summer of 2001. Note: graph starts at 60% to better show the change.

This would suggest a rising demand for rental properties.

Second, a large number of homes are now sitting vacant: This graph shows the homeowner vacancy rate. A normal rate for recent years appears to be about 1.7%.

This graph shows the homeowner vacancy rate. A normal rate for recent years appears to be about 1.7%.

The recent surge in homeowner vacancy rates is probably due to foreclosures and other distressed properties. Many REOs (lender Real Estate Owned) are left vacant until sold, and this has taken a number of housing units off the market.

Note that Fannie and Freddie have proposed a new program to keep tenants in foreclosed properties, but so far the standard lender practice is to evict tenants after foreclosure and let the house sit vacant.

So the first two graphs might suggest rising rents. Demand was rising as households moved from homeownership to renting, and the overall available supply of housing units was declining as many REOs were left vacant. And in fact, rents have been rising in many areas until now, from the LA Times story:

Nationwide, apartment rents eased 0.1% in the fourth quarter, the first drop since 2002, according to the analysis by research firm Reis Inc. ... according to [REIS] apartment rents fell in 54 out of 79 U.S. metropolitan areas in the fourth quarter of 2008.However the supply of rental units has been surging:

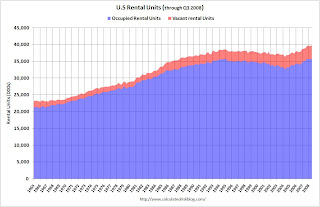

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been almost 3.5 million units added to the rental inventory. This increase in units almost offset the recent strong migration from ownership to renting, so the rental vacancy rate has only declined slightly (from a peak of 10.4% in 2004 to 9.9% in the most recent quarter).

Where did these 3.5 rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.05 million units completed as 'built for rent' since Q2 2004. This means that another 2.5 million rental units came from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, older out-of-service units being brought back to the rental market, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Note: it is also common in a recession for apartment vacancies to rise as households double up by moving in with a friends or family members.

Although there are several factors increasing the supply, I believe the surge in REO sales to cash flow investors is having a significant impact on rents. Many of those vacant homeowner units are being converted to rental properties - although this isn't showing up in the Census Bureau data yet (something to watch for).

And falling or flat rents will lead to lower house prices too. Here is a graph of the price-to-rent ratio using the Case-Shiller house price index through Q3 2008 and the Owners' Equivalent Rent (OER) from the BLS.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% to 70% complete as of Q3 2008 on a national basis.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 60% to 70% complete as of Q3 2008 on a national basis. However flat or falling rents would suggest even larger future house price declines to return to normal (as opposed to rising rents).