by Calculated Risk on 3/28/2009 03:30:00 PM

Saturday, March 28, 2009

Mauldin on Housing?

The following is a section on housing from John Mauldin's newsletter: Why Bother With Bonds?. I'd like to correct a few mistakes, not to embarrass Mr. Mauldin - we all make mistakes - but hopefully to illustrate a few points about the housing data.

From Mauldin:

Housing Sales Improve? Not HardlyUh, the numbers from the Census Bureau are seasonally adjusted. From the Census Bureau report:

I opened the Wall Street Journal and read that new home sales were up in February. Bloomberg reported that sales were "unexpectedly" up by 4.7%. I was intrigued, so I went to the data. As it turns out, sales were down 41% year over year, but up slightly from January.

But if you look at the data series, there was nothing unexpected about it. For years on end, February sales are up over January. It seems we like to buy homes in the spring and summer and then sales fall off in the fall and winter. It is a very seasonal thing.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.7 percent (±18.3%)* above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.Mauldin continues with the error:

emphasis added

If you use the seasonally adjusted numbers, you find sales were down 2.9% instead of up 4.7%. But the media reports the positive number. Interestingly, they report the seasonally adjusted numbers for initial claims, which have been a lot better than the actual numbers. Not that they are looking to just report positive news, you understand.As best I can tell, Mauldin is using the decline in inventory (from 340 thousand to 330 thousand) as the Seasonally Adjusted Annual Rate (SAAR) sales numbers. That shows a decline of 2.9%, but that is inventory - not sales.

The Not Seasonally Adjusted (NSA) monthly sales number are 27 thousand in February, compared to 23 thousand in January. An increase of 17.4%! If Mauldin is looking for an example of the media cherry picking SA vs. NSA, this isn't it.

Back to Mauldin:

Plus, as my friend Barry Ritholtz points out, the 4.7% rise was "plus or minus 18.3%". That means sales could have risen as much as 23% or dropped 13%. We won't know for awhile until we get real numbers and not estimates. Hanging your outlook for the economy or the housing market on one-month estimates is an exercise in futility, and could come back to embarrass you.Barry is correct - this is the 90% confidence interval from the Census Bureau. And I agree we should always be cautious with just one month of data.

More Mauldin:

But that brings up my final point tonight, and that is how data gets revised by the various government agencies. Typically with these government statistics, you get a preliminary number, which is a guess based on past trends, and then as time goes along that data is revised. In recessions like we are in now the revisions are almost always negative.First, the preliminary estimate is not a "guess"; the esimate is based on a sample. As more data is received, the estimate is refined, and the confidence interval narrows - but it is always an estimate (it is never "real numbers" or a "guess").

There is no conspiracy here. The people who work in the government offices have to create a model to make estimates. Each data series, whether new home sales, employment, or durable goods sales, etc., has its own unique sets of characteristics. The estimates are based on past historical performance. There is really no other way to do it.

So, past performance in a recession suggests higher estimates than what really happens. Then, the numbers in the following months are revised downward as actual numbers are obtained. But the estimates in the current months are still too high. That makes the comparisons generally favorable, at least for one month. And the media and the bulls leap all over the "data," and some silly economist goes on TV or in the press and says something like, "This is a sign that things are stabilizing." It drives me nuts.

Mauldin is correct about new home sales revisions being negative during the housing bust (something I've written about many times).

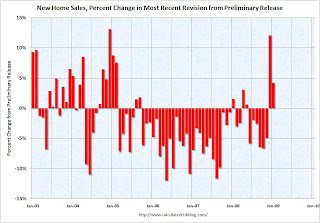

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the change from the preliminary release to the most recent release. Usually the revisions can be either positive or negative, but during the housing bust almost all the revisions were negative. For the two most recent months, the revisions have been positive, but there are more revisions to come.

Mauldin's conclusion is:

Ignore month-to-month estimated data. The key thing to look for is the direction of the revisions. If they are down, as they have been for over a year, then that is a bad sign. Further, one month's estimates are just noise. Look at the year-over-year numbers. When the direction of the revisions is positive and the year-over-year numbers are starting to stabilize, then we will know things are starting to turn around.I agree with his comment on revisions, although it takes several months to know if the data is being revised up or down.

Looking at year-over-year numbers is useful, but I think we can also look cautiously at the monthly numbers too. We needn't do this in a vacuum. Here is what I wrote early this year: Looking for the Sun

New home sales is a little more difficult because of the huge overhang of excess inventory that needs to be worked off. But some people will always buy new homes, and we can be pretty sure that sales won't fall another 270 thousand in 2009 (like in 2008), because that would put sales at 60 thousand SAAR in December 2009. That is not going to happen.And here was my take on the recent report: New Home Sales: Is this the bottom?. An excerpt:

So, at the least, the pace of decline in new home sales will slow in 2009. More likely sales will find a bottom - to the surprise of many.

This graph shows the February "rebound".

This graph shows the February "rebound". You have to look closely - this is an eyesight test - and you will see the increase in sales (if you expand the graph).

Not only was this the worst February in the Census Bureau records, but this was the 2nd worst month ever on a seasonally adjusted annual rate basis (only January was worse).

Note: Once again, I'm not trying to embarrass Mr. Mauldin, but hopefully this helps in looking at the housing data.