by Calculated Risk on 4/19/2009 02:17:00 PM

Sunday, April 19, 2009

Housing Activity Forecast

Reuters is quoting Freddie Mac chief economist Frank Nothaft as saying that he believes U.S. housing sales are near a bottom. Nothaft also said about one-third of all sales were foreclosure resales.

I disagree with Nothaft's forecast.

My view is:

Since there are far more existing home sales than new home sales, I expect that total sales activity will decline further.

Note: Please do not confuse a bottom in new home sales activity with a bottom in existing home prices. Please see: Housing: Two Bottoms

New Home Sales

With the huge overhang of existing home inventory - especially distressed inventory - it is theoretically possible for new home sales to go to zero. However, it is more likely that some people will always buy a new home, perhaps because of local supply and demand issues, or maybe they just prefer a new home, or perhaps other reasons. Whatever the reason, I think new home sales are near a bottom.

My 2005 call of a top for new home sales was based on objective factors, however calling the bottom is somewhat more subjective.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows new home sales since 1963. The Census Bureau reported that New Home Sales in February were at a seasonally adjusted annual rate of 337 thousand.

This puts February 2009 sales more than 75% below the peak of July 2005, and near the lowest level since the Census Bureau started tracking sales in 1963 (note: only January 2009 sales at 322 thousand SAAR were lower than February).

These sales number are not adjusted for changes in population or number of households - and adjusting for population changes would make current sales look even worse.

As I noted above, it is possible for new home sales to fall further, however since the economy has just come through a period of very tight credit, and extremely low consumer confidence, my guess is this has pushed new home sales to - or near - the bottom for this cycle.

Additional evidence comes from the NAHB builder confidence index. The index increased in April, especially for traffic of prospective buyers. And, anecdotally, the home builders I've spoken with, are all telling me activity has picked up recently.

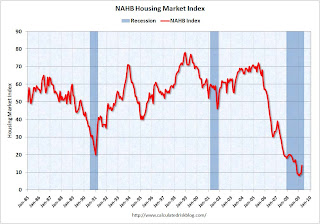

Additional evidence comes from the NAHB builder confidence index. The index increased in April, especially for traffic of prospective buyers. And, anecdotally, the home builders I've spoken with, are all telling me activity has picked up recently.This graph shows the builder confidence index from the National Association of Home Builders (NAHB). The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

This is fairly subjective, but I think new home sales are at or near a bottom.

Existing Home Sales

Perhaps we could make the same argument about existing home sales - the economy has just come through a period of very tight credit, and extremely low consumer confidence - depressing sales. But there is another factor to consider for existing home sales; foreclosure resales.

Important note: Foreclosures (the transfer from homeowner to lender) are NOT counted in existing home sales. However when the lender sells the property to a new homeowner, it is counted.

This graph shows existing home sales (left axis) and new home sales (right axis) through February.

This graph shows existing home sales (left axis) and new home sales (right axis) through February. Normally there about 6 times as many existing home sales as new home sales. For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. In recent months this ratio has been close to 14!

In my opinion, the change in the ratio was caused primarily by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Freddie Mac's Frank Nothaft says about one-third of all sales are foreclosure resales. Lawrence Yun, NAR chief economist, recently said "[D]istressed sales accounted for 40 to 45 percent of transactions in February.” Yun is including short sales in addition to foreclosure resales.

These REO resales are real sales and should be included in the NAR statistics, but I suspect these REO buyers might hold these properties longer than recent turnover would suggest. If these are owner occupied buyers, they have probably been waiting to buy, and they have saved a down payment and qualified under the tighter lending standards. They probably won't sell until they can make a reasonable profit to buy a move up home - and it will probably be a number of years before prices recover.

If they are investors, they are likely buying REOs for cash flow - not appreciation, unlike the speculators in recent years - and these investors will probably hold the properties for a number of years too.

And what about all those homeowners with negative equity? If they manage to avoid foreclosure, they will be stuck in their homes for years.

This suggests to me that the turnover rate will slow.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the February rate of 4.7 million units.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the February rate of 4.7 million units.I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for February).

Currently the turnover rate for existing homes is about 6.2% of owner occupied units, still above the median of the last 40 years (6.1%).

Although there may be some increase in existing home sales over the next few months (as foreclosure resales stay elevated), I expect the turnover rate to fall further - perhaps much further - and for existing home sales to decline over the next couple of years.