"In the last few months you've seen a real pickup in activity although at much lower prices," Buffett said, citing data from Berkshire's real estate brokerage business, which is one of the largest in the U.S.Also from MarketWatch: Buffett: Consumer spending slump not over

...

"We see something close to stability at these much-reduced prices in the medium to lower part of the market," Buffett said.

The recent drop in consumer spending and the resulting pressure on retailing, manufacturing and services industries could last "quite a long time," Berkshire Hathaway Chairman Warren Buffett said Saturday.

"I think our retail businesses will not do well for some time" as U.S. consumers save more, Buffett told investors at the company's annual shareholders meeting. "I would not look for any quick rebound in retail, manufacturing and services businesses."

Click on graph for large image.

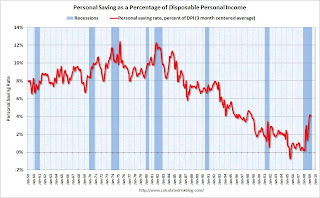

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report released yesterday. The saving rate was 4.1% in March.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but, as Buffett notes, this will also keep pressure on personal consumption.