by Calculated Risk on 5/05/2009 12:26:00 PM

Tuesday, May 05, 2009

Fact Checking Bernanke on Real Estate

Here are some comments by Fed Chairman Ben Bernanke on real estate:

Data: Existing home sales peaked in June 2005, new home sales in July 2005, and housing starts in January 2006. Prices peaked in July 2006 (Case-Shiller Composite 10 index) and residential investment has been a drag on GDP starting in Q1 2006. If anything, the housing market has been in decline for almost four years.

Click on graph for larger image in new window.

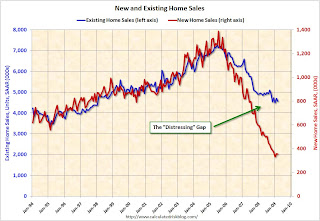

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) since January 1994 through March 2009.

If you look closely, you can see that Bernanke is correct that existing home sales have been "fairly stable since late last year" and "new homes have firmed a bit recently".

Note: I believe the recent gap between existing and new home sales was caused by distressed sales. With all of the REO and short sales, builders can't compete. This has pushed down new home sales, and kept existing home sales relatively high (compared to new home sales).

But I believe Bernanke is wrong about both new and existing home sales being at "depressed levels".

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.There is no question that new home sales are at depressed levels. This is the lowest level of new home sales activity since the Census Bureau started tracking the data in 1963. And this data is not adjusted for changes in population (or number of households), and that would make the current slump even worse.

But the story is different for existing home sales:

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the March rate of 4.57 million units.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the March rate of 4.57 million units.I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for March).

The turnover rate is just below the median of the last 40 years - and will probably fall further in coming years.

Existing home sales are not at "depressed levels", unless you exclude all the foreclosure resales.

I think foreclosure resales are much more significant than lower mortgage rates. According to the NAR, something like 40% to 45% of all existing home sales are distressed (Foreclosure resales or short sales). And according to DataQuick in California:

Of the existing homes sold last month [March], 57.4 percent were properties that had been foreclosed on. A year ago it was 35.5 percent.I'd argue that the primary reason existing home sales appear to have stabilized is because of foreclosure-related activity.

This is correct. New home inventory is declining and new home sales have been higher than new home "built for sale" starts since late 2007 (see Quarterly Housing Starts and New Home Sales). Progress is being made on reducing inventory, but the months of supply is still elevated (at 10.7 months in March).

"Poor" doesn't describe the level of distress, but Bernanke is correct. About a month ago I compiled a summary of articles and data for retail, offices, apartments and lodging: Vacancies, vacancies, vacancies ... and falling rents There has been more data since then, but it all shows vacancy rates are rising in all categories (occupancy rates falling for hotels), and rents (and room rates) are falling. Conditions in CRE are definitely grim.

My only disagreement with Dr. Bernanke is on the existing home market. I don't think current existing home sales are "depressed" and I believe sales will fall further in the future.