From the NY Times:

Shift to Saving May Be Downturn’s Lasting Impact The economic downturn is forcing a return to a culture of thrift that many economists say could last well beyond the inevitable recovery.

This is not because Americans have suddenly become more financially virtuous or have learned the error of their free-spending ways. Instead, these experts say, Americans may have no choice but to continue pinching pennies.

This shift back to thrift may seem to be a healthy change for a consumer class known for spending more than it earns, but there is a downside: American businesses have become so dependent on consumer spending that any pullback sends ripples through the economy.

The NY Times article notes the need to repair household balance sheets, but there is a second factor that will push up the saving rate too: changing demographics. Here is what I

wrote a week ago:

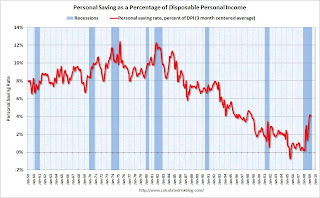

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report. The saving rate was 4.1% in March.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but ... this will also keep pressure on personal consumption.

I expect the saving rate to continue to rise to 8% or so, although the future increases will probably not be as rapid as the last few months.

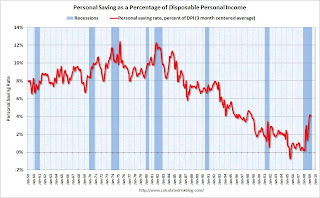

Click on graph for large image.

Click on graph for large image.