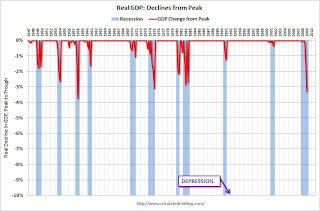

WHAT is the chance that the current downturn will morph into another Great Depression? That question has been preoccupying people for months.Here is a graph comparing the decline in real GDP for the current recession with other recessions since 1947. Depression is marked on the graph as -10%.

The popular mood has a huge impact on the economy, so it’s worth noting what many people seem to forget: Depression scares come and go. And by one authoritative measure, the current outbreak of concern has been surprisingly mild.

The University of Michigan Surveys of Consumers have included in their regular measurements this specific question about fear of a prolonged depression:

“Looking ahead, which would you say is more likely — that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or what?”

... A high score on the question means that the answers tilted toward continuous good times, with a low score tilting toward unemployment or depression. Since 1960, the average score has been 94.

If we define a depression scare as any time the score is below 65, there have been four such scares since 1951. They were in the periods from 1974 to 1975, during which 47 was the lowest score; from 1978 to 1982, with a low of 41; from 1990 to 1992, with a low of 54; and from 2008 to 2009, with a low (to date) of 59. Note that so far, at least, the worst reading in the current scare has not been as bad as those of the previous episodes.

In each case, the scare’s significance is further confirmed by electronically counting in news databases the number of articles containing the word pair “great depression.” There were huge peaks in the count during these periods.

Click on table for larger image in new window.

Click on table for larger image in new window.After the 6.1% SAAR decline in Q1 2009 GDP, the cumulative real decline is now 3.3% from the peak.

NOTE: GDP is reported on a real (inflation adjusted) Seasonally Adjusted Annual Rate (SAAR) basis. Real GDP declined about 1.5% in Q1.

Even though the current recession is already one of the worst since 1947, it is only about 1/3 of the way to a depression (commonly defined as a 10% decline in real GDP).

Stated another way, to reach a depression, the economy would have to decline at about the same annual rate as the last two quarters for the next four quarters.

Just to put this in perspective, during the Great Depression, real GDP declined 26.5% from the peak to the trough.

I believe the odds of the current recession becoming a depression are very low (much less another Great Depression), but I think the current period has far greater risks than those earlier periods because of the severe financial crisis.