by Calculated Risk on 6/12/2009 12:28:00 PM

Friday, June 12, 2009

Credit Indicators

Here is another look at a few credit indicators:

From Dow Jones: Key US Dollar Libor Rate Falls To Record Low

The cost of borrowing longer-term U.S. dollars in the London interbank market fell Friday, with the three-month rate reaching its lowest level since the advent of British Bankers Association Libor fixings back in 1986 as funding pressures continued to ease.

Data from the BBA showed three-month dollar Libor, seen as a key gauge of the effectiveness of the Federal Reserve's monetary policy, dropped to 0.62438% from Thursday's 0.62938%.

The three-month rate peaked at 4.81875% on Oct. 10.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There has been improvement in the A2P2 spread. This has declined to 0.55. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread is now down to the normal range of 46.21. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

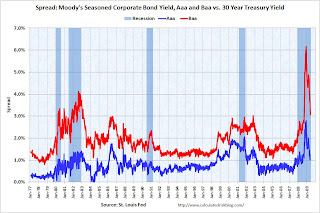

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply, but the spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined steadily.