by Calculated Risk on 6/16/2009 08:30:00 AM

Tuesday, June 16, 2009

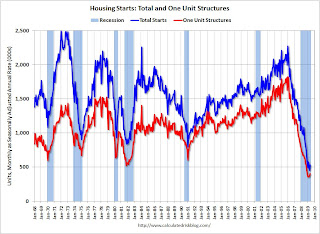

Housing Starts May

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 532 thousand (SAAR) in May, rebounding from the all time record low in April of 454 thousand. The previous record low was 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 401 thousand (SAAR) in May; above the record low in January and February (357 thousand) and above 400 thousand for the first time since last November.

Permits for single-family units were 408 thousand in May, suggesting single-family starts will remain at about the same level in June.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 518,000. This is 4.0 percent (±1.7%) above the revised April rate of 498,000, but is 47.0 percent (±2.1%) below the May 2008estimate of 978,000.

Single-family authorizations in May were at a rate of 408,000; this is 7.9 percent (±1.5%) above the revised April figure of 378,000.

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 532,000. This is 17.2 percent (±14.4%) above the revised April estimate of 454,000, but is 45.2 percent (±5.8%) below the May 2008 rate of 971,000.

Single-family housing starts in May were at a rate of 401,000; this is 7.5 percent (±14.2%)* above the revised April figure of 373,000.

Housing Completions:

Privately-owned housing completions in May were at a seasonally adjusted annual rate of 811,000. This is 3.3 percent (±20.6%)* below the revised April estimate of 839,000 and is 28.8 percent (±11.1%) below the May 2008 rate of 1,139,000.

Single-family housing completions in May were at a rate of 491,000; this is 9.4 percent (±13.8%)* below the revised April figure of 542,000.

Note that single-family completions of 491 thousand are still significantly higher than single-family starts (401 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

It is still too early to call the bottom for single family starts in January, however I do expect single family housing starts to bottom sometime in 2009.