by Calculated Risk on 7/28/2009 09:00:00 AM

Tuesday, July 28, 2009

Case-Shiller House Prices for May

Important Note: Case-Shiller hasn't released the Seasonally Adjusted data yet for May. There is a strong seasonal pattern for prices and this is the NSA data.

S&P/Case-Shiller released their monthly Home Price Indices for May this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.3% from the peak, and up slightly in May.

The Composite 20 index is off 32.3% from the peak, and up slightly in May.

NOTE: This is the NSA data, prices probably fell using the SA data. The second graph shows the Year over year change in both indices.

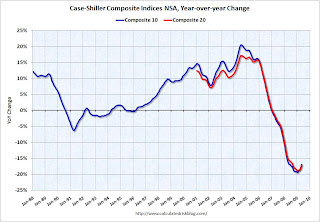

The second graph shows the Year over year change in both indices.

The Composite 10 is off 16.8% over the last year.

The Composite 20 is off 17.1% over the last year.

This is still a very strong YoY decline.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (NSA) in 14 of the 20 Case-Shiller cities in May. In Phoenix, house prices have declined 54.5% from the peak. At the other end of the spectrum, prices in Dallas are only off about 8% from the peak. Prices have declined by double digits almost everywhere.

Prices increased (NSA) in 14 of the 20 Case-Shiller cities in May. In Phoenix, house prices have declined 54.5% from the peak. At the other end of the spectrum, prices in Dallas are only off about 8% from the peak. Prices have declined by double digits almost everywhere.

I'll compare house prices to the stress test scenarios soon.