by Calculated Risk on 7/17/2009 09:39:00 AM

Friday, July 17, 2009

GE Conference Call Comments

Some comments from the GE Conference call (comments from Brian):

GE: If you look at the environment and the global landscape not much has changed from how we saw it at EPG [investor presentation?]. We're seeing growth in selected markets. Parts of the globe are still robust. China and the middle east, India, places like that. Deflation is helping our margins.

just talking about orders and backlog, we had about $18 billion of second quarter orders, slightly below first quarter and down about 23% FX adjusted versus last year. We're down about 16% year to date. The backlog remains strong. The orders were about the same level as '06 and '07. Backlog remains very strong at $169 billion. If you just look at the orders in some context we had a record first half of '08. That was really the peak of what we saw for major equipment orders. We built $30 billion of backlog over the last four years so we really expected orders to be down even without the recession. A couple positives with major equipment, cancellations are very low. Cancellations are like $100 million…If you look at our backlog conversion rate and current orders and look forward, maybe 12 months, and you think about the fact that about two-thirds of any given year's revenue convert from backlog, and the other third represent current year orders, we look at a rough estimate for 2010 at about, with equipment revenue down about 10 to 15%, some where in that range.

Quick update on stimulus and global growth. First with stimulus. We talked about at EPG having about $190 billion potential from a stimulus standpoint. Almost nothing has come out from this so far. The major buckets are clean energy, affordable healthcare, and then a scattering of other projects. We're seeing some early wins in smart grid with orders up 70%. As we said, the wind tax credits have been clarified. China spending is very strong. We're starting to get some bidding on health information changes and seeing some decent activity around the nuclear business. If you look at it from a global standpoint, some of the global regions are still extremely strong. China was up 31%, India up 46%, Middle East up 10% despite the fact that we're only beginning the Iraq shipments and order completion.

GE Capital

Delinquencies – Equipment and Real Estate [US improved and Asia is worse????]

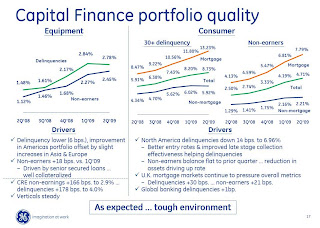

Next is an update on our delinquencies in non earnings. On the left side is the commercial equipment finance data. You can see the 30 plus day delinquencies for equipment are down six basis points in Q2 versus Q1. That was driven by a decline in delinquencies in the Americas where 30 plus went from 2.81% to 2.45%. So we're very interested in watching this trend and seeing how this develops as we go through the year. That was partially offset by, we had some increased delinquencies in our Asia and European equipment books. We continue to see pressure on non earnings, up 18 basis points versus the first quarter but again the pace of that growth has also leveled off a bit. It's driven by senior secured loans where we're well collateralized. In terms of real estate, which is not in the delinquency for the equipment bar up above, delinquencies increased up to 4% [up 178BP Q/Q] on the real estate book and non earnings are up to 2.9% [up 166BP Q/Q]. You can see we continue to see pressure in the commercial real estate book,  Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the GE Investor Presentation material.

Delinquencies – Consumer

On the right side, consumer data, and this is really developing into the two different categories by type of exposure. We broke out mortgage, global mortgage, and nonmortgage because loss dynamics are so different. You can see the improvements in the non mortgage delinquency as the delinquency went from 6.02 in the first quarter down to 5.92 in the second quarter and that's driven by North America . North American delinquencies are down 14 basis points to 6.96%. We're seeing better entry rates in delinquency. We're seeing improved late-stage collection effectiveness. The non earnings balance was flat to the prior quarter, and the reason the rate increase a little bit is because the balance is down. So as a percent it's a little higher, but we are getting the benefit of all the underwriting actions that we took last year as well as some seasonality benefits. And then the second category are the global mortgage assets. We continue to see growth in 30 plus delinquencies and non earnings. UK mortgage book drives most of the changes

Reserves

Next is an update on how we think about the non earning assets and our reserve coverage. The left side is commercial. Non earnings ended the quarter at 6.4 billion. It's up 1.9 billion from Q1. This represents 2.9% of financing receivables. The bars show the benefit of being senior secured lender. We expect 1.9 billion of non earnings to have 100% recovery. We have another 1.2 billion some type of workout where we expect full recovery. We'll have a renegotiation, some changes to the documents and terms, and then we have another 1.9 billion where we're protected by collateral value. At the end of the day that leaves with you 1.4 billion of estimated loss exposure today. You can see we have 173% coverage with our reserves. [To summarize, they are expecting a 78% recovery on what is largely a junk grade portfolio albeit in a senior secured position] On the right side of the consumer non-earning assets of $6.6 billion and they were up over Q1, represent about 4.7% of the financing receivables. The consumer dynamics are very different between the mortgage and the nonmortgage assets so the green bar represents our non mortgage non earning assets, principally the US retail business, the credit card business and retail sales finance. We have 1.7 billion dollars of non earnings in that book. And we have 3.3 million of reserves against it, 189% coverage. And then the remainder of the non-earning assets on the global mortgage book we expect 1.5 billion of that to cure. With our underwriting positions we expect to recover $2.9 billion of exposure based on loan to value position. We underwrite at about 70 to 75% loan to value. Today they're at about 85% loan to value as house prices have declined. We have some mortgage insurance we expect to recover on leaving with expected loss of $500 million, 173% coverage without that. We believe we're appropriately reserved for non-earning loss exposure. We'll cover more in detail on the 28th meeting. [To summarize, they expect 30% of their non performing mortgage assets to cure, the value of the underlying assets in their mortgage book are down 12-18% from origination, they expect a 15% loss severity rate (including a modest benefit from mortgage insurance) - these guys must the gods of mortgage underwriting – if anyone wants to bet on the trend of future loss estimates, I’ll take the over – their corporate motto “Imagination at Work” seems fully appropriate here )

On the right side of the consumer non-earning assets of $6.6 billion and they were up over Q1, represent about 4.7% of the financing receivables. The consumer dynamics are very different between the mortgage and the nonmortgage assets so the green bar represents our non mortgage non earning assets, principally the US retail business, the credit card business and retail sales finance. We have 1.7 billion dollars of non earnings in that book. And we have 3.3 million of reserves against it, 189% coverage. And then the remainder of the non-earning assets on the global mortgage book we expect 1.5 billion of that to cure. With our underwriting positions we expect to recover $2.9 billion of exposure based on loan to value position. We underwrite at about 70 to 75% loan to value. Today they're at about 85% loan to value as house prices have declined. We have some mortgage insurance we expect to recover on leaving with expected loss of $500 million, 173% coverage without that. We believe we're appropriately reserved for non-earning loss exposure. We'll cover more in detail on the 28th meeting. [To summarize, they expect 30% of their non performing mortgage assets to cure, the value of the underlying assets in their mortgage book are down 12-18% from origination, they expect a 15% loss severity rate (including a modest benefit from mortgage insurance) - these guys must the gods of mortgage underwriting – if anyone wants to bet on the trend of future loss estimates, I’ll take the over – their corporate motto “Imagination at Work” seems fully appropriate here )