by Calculated Risk on 7/08/2009 08:38:00 PM

Wednesday, July 08, 2009

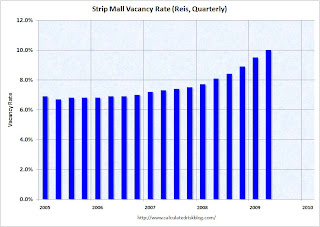

Reis: Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Reis reports the strip mall vacancy rate hit 10% in Q2 2009, the vacancy rate since highest since 1992. And rents are cliff diving ...

From Reuters: U.S. mall vacancy rate soars, rent dives - report

During the second quarter, the vacancy rate at U.S. strip malls reached 10 percent, the highest level since 1992, [Reis] said. ... asking rent fell 1.7 percent from a year ago to $19.28 per square foot. Asking rent fell 0.7 percent from the prior quarter. It was the largest single-quarter decline since Reis began tracking quarterly figures in 1999. ... effective rent declined 3.2 percent year-over-year to $17.01 per square foot. Effective rent fell 1.1 percent from the prior quarter.A record decline in rents. Record regional mall vacancies. And no recovery seen in the retail CRE sector "until 2012 at the earliest". Grim.

About 7.9 million square feet of space was returned to the market during the quarter. The amount was second only to the 8.1 million square feet in the first quarter. ... U.S. regional malls ... vacancy rate rose to 8.4 percent, the highest vacancy level since Reis began tracking regional malls in 2000. Asking rents for regional malls continued to deteriorate but at a faster rate, falling 1.4 percent in the second quarter, compared with 1.2 percent in the first. ...

"Right now it looks like all signs are pointing to rents and vacancies, big components of income, getting shot down," [Victor Calanog, director of research for Reis] Inc said. "Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."