by Calculated Risk on 8/10/2009 11:58:00 PM

Monday, August 10, 2009

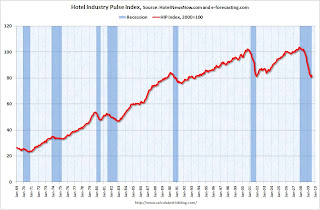

Hotel Industry Pulse Index Shows Slight Improvement in July

From HotelNewsNow.com: HIP increases by 1.6 in July; first sign of turning point

This morning, economic research firm e-forecasting.com, in conjunction with Smith Travel Research, announced that after 19 months of consecutive decline, HIP climbed 1.6 percent in July. HIP, the Hotel Industry’s Pulse index, is a composite indicator that gauges business activity in the US hotel industry in real-time. The latest increase brought the index to a reading of 82.2. The index was set to equal 100 in 2000.

...

“With HIP finally showing a slight improvement after 19 months of decline, it appears we may be seeing the light at the end of the tunnel” said Chad Church, Industry Research Manager at STR. “It will be important to monitor the pace of growth in the HIP over the second half of the year to see if July was an anomaly or a true turning point in this recession.”

...

The composite indicator is made with the following components: revenues from consumers staying at hotels and motels adjusted for inflation, room occupancy rate and hotel employment, along with other key economic factors that influence hotel business activity.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index suggests that the cliff diving for the hotel industry might be over, although this is just one data point.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off over 15% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

The end to cliff diving is not the same as new growth, but it is better than more cliff diving!

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.