by Calculated Risk on 8/04/2009 08:31:00 AM

Tuesday, August 04, 2009

June PCE and Personal Saving

From the BEA: Personal Income and Outlays, June 2009

Personal income decreased $159.8 billion, or 1.3 percent, and disposable personal income (DPI) decreased $143.8 billion, or 1.3percent, in June, according to the Bureau of Economic Analysis.The temporary boost in the May saving numbers due to timing of American Recovery and Reinvestment Act of 2009 stimulus payments was reversed in June.

...

The June change in personal income reflects selected provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current transfer receipts in May much more than in June. Excluding these receipts ... personal income decreased $7.8 billion, or 0.1 percent, in June, following a decrease of $2.5 billion, or less than 0.1 percent, in May.

...

Real PCE -- PCE adjusted to remove price changes –- decreased 0.1 percent in June, in contrast to an increase of less than 0.1 percent in May.

...

Personal saving -- DPI less personal outlays -- was $504.8 billion in June, compared with $681.0 billion in May. Personal saving as a percentage of disposable personal income was 4.6 percent in June, compared with 6.2 percent in May.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the June Personal Income report. The saving rate was 4.6% in June. (5.4% with three month average)

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

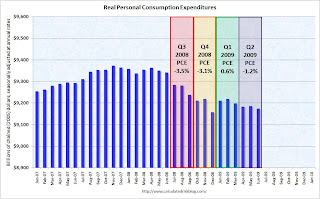

The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and has been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.