by Calculated Risk on 9/23/2009 08:58:00 AM

Wednesday, September 23, 2009

MBA: 30 Year Mortgage Rates Fall Below 5 Percent

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, increased 12.8 percent on a seasonally adjusted basis from one week earlier, which was a holiday shortened week. ...

The Refinance Index increased 17.4 percent from the previous week as, for the first time since mid-May, the 30-year fixed rate dipped below 5 percent. The seasonally adjusted Purchase Index increased 5.6 percent from one week earlier, driven by applications for government-insured loans.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.97 percent from 5.08 percent ...

Click on graph for larger image in new window.

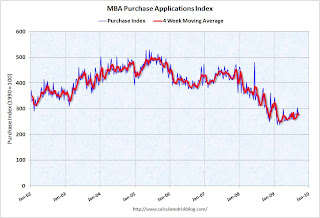

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.