by Calculated Risk on 10/13/2009 11:18:00 AM

Tuesday, October 13, 2009

CRE in San Diego, Orange County and Las Vegas: Higher Vacancy Rates, Lower Rents

Voit released Q3 quarterly reports today for CRE in Las Vegas, San Diego and Orange County.

The reports show the vacancy rates are up and lease rates falling. It also shows new construction has slowed sharply. Here are a couple of graphs for Orange County and San Diego. We are seeing a similar pattern nationwide ...

Click on graph for larger image in new window.

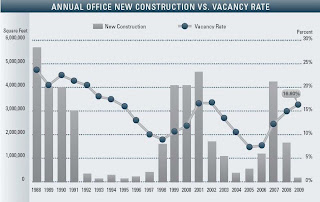

This graph shows the annual Orange County office vacancy rate and new construction since 1988. See Voit report for more.

Note that in the previous slumps, office construction didn't pick up until the vacancy rate dropped below 10%.

From the Voit report:

Net absorption for the county posted a negative 438,803 square feet for the third quarter of 2009, giving the office market a total of 1.92 million square feet of negative absorption for the year.

...

The average asking Full Service Gross (FSG) lease rate per month per foot in Orange County is currently $2.24, which is a 16.73% decrease over last year’s rate of $2.69 and five cents lower than last quarter’s rate.

...

Total space under construction checked in at 166,455 square feet at the end of the third quarter, which is less than half the amount that was under construction this same time last year.

emphasis added

The second graph is for San Diego. The dynamics are similar, but absorption is slighly positive in San Diego. From Voit:

The second graph is for San Diego. The dynamics are similar, but absorption is slighly positive in San Diego. From Voit: Net absorption for the county posted a positive 346,030 square feet for the third quarter of 2009, giving the office market a total of 653,537 square feet of positive absorption for the year.Once again, investment in new office space will probably not increase until the vacancy rate is below 10%.

...

The average asking Full Service Gross (FSG) lease rate per month per foot in San Diego County is currently $2.39, which is a 12.8% decrease over last year’s rate of $2.74 and eight cents lower than last quarter’s rate. The record high rate of $2.76 was established in the first and second quarter of 2008.

Although Voit didn't provide a similar graph for Las Vegas, the situation is clearly worse:

The amount of occupied space valley-wide fell to 38.2 million, a level not witnessed since the second quarter of 2007. The average vacancy rate reached 22.7 percent, which represented a 0.7-point increase from the preceding quarter (Q2 2009). Compared to the prior year (Q3 2008), vacancies were up 5.7 points from 17.0 percent.New office construction has slowed significantly in these markets, and will not pick up until vacancy rates drop sharply.

...

On an annualized basis, new supply has dwindled and less than one million square feet of new supply is expected to enter the market during 2009, a figure not seen since 2003. We expect even less development in 2010 with a plug on the development pipe until the supply-demand imbalance corrects itself.