by Calculated Risk on 11/09/2009 03:19:00 PM

Monday, November 09, 2009

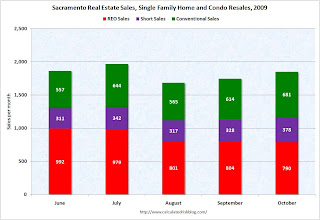

Distressed Sales: Sacramento as Example

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

UPDATE: percentages corrected.

Here is the October data.

They started breaking out REO sales last year, but this is only the fifth monthly report with short sales. About 63.2 percent of all resales (single family homes and condos) were distressed sales in October. The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

Total sales in October were off 17.5% compared to October 2008; the fifth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (28.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in distress.