by Calculated Risk on 11/21/2009 11:01:00 AM

Saturday, November 21, 2009

FDIC Bank Failure Update

Note: The FDIC will probably release the Q3 Quarterly Banking Profile next week. The report will show the number of banks on the problem bank list, and the status of the Deposit Insurance Fund (DIF).

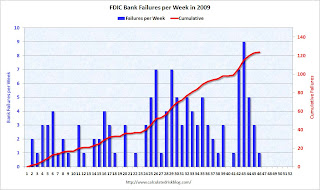

The FDIC closed another bank on Friday, and that brings the total FDIC bank failures to 124 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The bank failures seem to come in bunches, and with 6 weeks to go it seems 140 to 150 or so bank failures is likely this year.

The 2nd graph covers the entire FDIC period (annually since 1934). This is the most failures per year since 1992 (181 failures).

This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now close to $50 billion.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.