by Calculated Risk on 11/20/2009 01:43:00 PM

Friday, November 20, 2009

National Survey: Data on Home Buying Financing

Here is some national data on home buyer financing in October. This is from a survey by Campbell Communications (excerpted with permission) released today.

Source: October Trends in Existing Home Sales, a presentation from Campbell/Inside Mortgage Finance Monthly Survey on Real Estate Market Conditions.

Thomas Popik, Campbell Surveys Research Director, highlighted several key trends from the survey in October:

Investor Purchases of REO Are Declining First-Time Homebuyers Largely Support the Market First-Time Homebuyers Dependent on FHA Financing If FHA Guidelines Get Tougher, Look for Large Impact Short Sale Inventory and Transactions Are Booming First-Time Homebuyer Traffic Is Starting to Ease

Click on graph for larger image in new window.

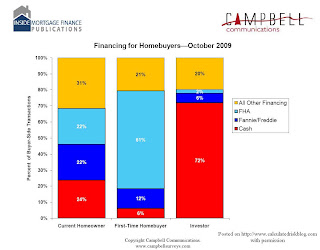

Click on graph for larger image in new window.The first chart shows the type of financing used in October.

The cash buyers were mostly investors (frequently buying damaged REOs), and the FHA buyers were mostly first time homebuyers.

The second graph shows the financing breakdown by buyer type.

According to the survey investors bought 15% of homes in October. About 72% of these purchases were cash.

According to the survey investors bought 15% of homes in October. About 72% of these purchases were cash.Current homeowners bought 38% of homes sold in October and used a mix of financing.

First-time homebuyers accounted for 47% of purchases and were mostly buying using FHA insured loans.