by Calculated Risk on 12/12/2009 08:52:00 AM

Saturday, December 12, 2009

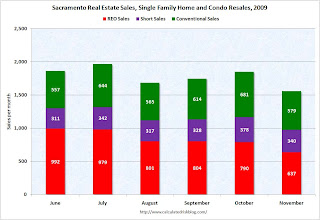

Distressed Sales: Sacramento Market as an Example

Note: The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the November data.

They started breaking out REO sales last year, but this is only the sixth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in November. The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

The second graph shows the mix for the last six months. It will be interesting to see if foreclosure resales pick up early next year when the early trial modifications period is over.

Total sales in November were off 16.1% compared to November 2008; the sixth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (26.4%) or FHA loans (31.4%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in severe distress.