by Calculated Risk on 12/14/2009 10:35:00 AM

Monday, December 14, 2009

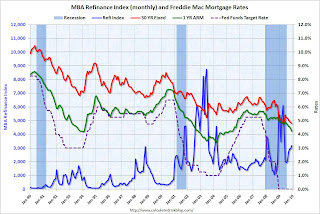

Refinance Activity and Interest Rates

The Mortgage Bankers Association's (MBA) current forecast for refinance activity in 2010 is $693 billion, and falling further in 2011 to $591 billion. The MBA is currently estimating 2009 refinance originations will be $1,246 billion - so they expect activity to fall almost in half.

This gives me an excuse for a graph or two (as if I need one). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Refinance activity picks up when mortgage rates fall (for obvious reasons), and this graph shows the monthly refinance activity (MBA refinance index) and the Freddie Mac 30 year fixed mortgage rate and one year adjustable mortgage rate - and the Fed Funds target rate since Jan 1990.

Mortgage rates would have to fall further in 2010 to get another increase in refinance activity, and with the Fed MBS purchase program scheduled to end by the end of Q1, it seems unlike that rates will fall - unless the program is extended or the economy weakens significantly.

Notice that following the '90/'91 and '01 recessions, the Fed kept lowering the Fed Funds rate because of high unemployment rates. This spurred refinance activity. The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen in 2010 and 2011 - there will only be a surge in refinance activity if rates fall below the rates of 2009.