by Calculated Risk on 12/31/2009 10:20:00 AM

Thursday, December 31, 2009

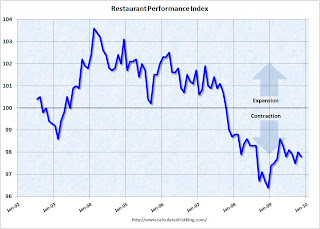

Restaurant Index Shows Contraction in November

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain as the Restaurant Performance Index Declined for the Third Time in the Last Four Months

[T]he National Restaurant Association’s ... Restaurant Performance Index (RPI) ... stood at 97.8 in November, down 0.2 percent from its October level. In addition, the RPI remained below 100 for the 25th consecutive month, which signifies contraction in the index of key industry indicators.

“Although the RPI remained below 100 for the 25th consecutive month, which signals contraction, restaurant operators are cautiously optimistic that conditions will improve in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported a positive six-month sales outlook for the first time in three months, and remained optimistic that the economy will improve during the next six months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.0 in November – down 0.5 percent from October and tied for its second-lowest level on record. In addition, November represented the 27th consecutive month below 100, which signifies contraction in the current situation indicators.

Restaurant operators reported negative same-store sales for the 18th consecutive month in November, with the overall results similar to the September and October performances. ...

Customer traffic also remained soft in November, as restaurant operators reported net negative traffic for the 27th consecutive month. ...

Along with soft sales and traffic levels, operators reported a dropoff in capital spending activity. Thirty-three percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, down from 40 percent who reported similarly last month.

emphasis added