by Calculated Risk on 1/28/2010 10:41:00 PM

Thursday, January 28, 2010

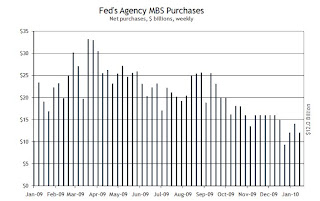

Fed MBS Purchases by Week

This graph from the Atlanta Fed weekly Financial Highlights shows the Fed MBS purchases by week:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to $1.164 trillion or just over 93% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of January 20. This purchase brings its total purchases up to $1.152 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 92% complete).

This shows that the Fed has slowed down purchases significantly from earlier this year, but so has the issuance of Fannie and Freddie MBS - so I don't think the slowdown has impacted mortgage rates yet.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.It sounds like the refinance boom is ending, from the MBA this week:

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”With 9 weeks to go, the Fed needs to average just under $10 billion in net purchases per week.