by Calculated Risk on 2/24/2010 05:03:00 PM

Wednesday, February 24, 2010

97,000 Homeowners in "Loan Mod Limbo"

Paul Kiel at ProPublica reports: Chase and Other Servicers Leave Many in Loan Mod Limbo; Treasury Threatens Penalties

About 97,000 homeowners in the government’s mortgage modification program have been stuck in a trial period for over six months. Most of them, about 60,000, have their mortgages with a single mortgage servicer, JPMorgan Chase.Paul Kiel has much more.

Trial periods are designed to last only three months, after which mortgage servicers are supposed to either give homeowners a permanent modification or drop them from the program. According to a ProPublica analysis, about 475,000 homeowners have been in a trial modification for longer than three months.

A couple of key points on HAMP I've mentioned before:

The January guidance from Treasury addressed both of the above points.

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests that there will be fewer trial modifications per month in the future (this is already happening, see graph below) and a surge of trial cancellations in February.

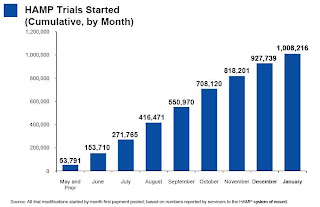

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.