by Calculated Risk on 2/22/2010 08:33:00 AM

Monday, February 22, 2010

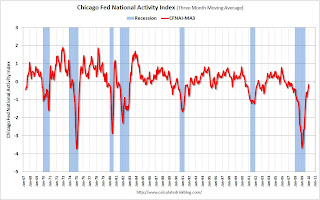

Chicago Fed: Economic Activity Increased in January

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity increased sharply in January

The Chicago Fed National Activity Index was +0.02 in January, up from –0.58 in December. ...

The index’s three-month moving average, CFNAI-MA3, increased to –0.16 in January from –0.47 in December, reaching its highest level since July 2007. January’s CFNAI-MA3 suggests that, consistent with the early stages of a recovery following a recession, growth in national economic activity is beginning to near its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 indicates subdued inflationary pressure from economic activity over the coming year.

Production-related indicators made a positive contribution to the index for the seventh consecutive month. As a group, they contributed +0.45 in January, up from +0.14 in December. ...

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A CFNAI-MA3 value below –0.70 following a period of economic expansion indicates an increasing likelihood that a recession has begun. A CFNAI-MA3 value above –0.70 following a period of economic contraction indicates an increasing likelihood that a recession has ended. A CFNAI-MA3 value above +0.20 following a period of economic contraction indicates a significant likelihood that a recession has ended.Although the CFNAI-MA3 improved in January, the index is still negative. According to Chicago Fed, it is still too early to call the official recession over - although the likelihood that a recession has ended is increasing.