by Calculated Risk on 3/26/2010 11:41:00 AM

Friday, March 26, 2010

HAMP Principal Write-downs

There are a number of changes to HAMP announced today. This includes help for unemployed homeowners and more outreach. David Streitfeld at the NY Times gives an overview: U.S. Plans Big Expansion in Effort to Aid Homeowners.

Here is a fact sheet from Treasury on these changes.

The key changes are principal reductions and larger payments to 2nd liens (including for HAFA short sales). For short sales, the 2nd lien payment has been doubled from 3% of the outstanding balance to 6% - although this is probably still below the typical recovery rate for 2nd liens.

From Treasury on short sales (and deed-in-lieu):

Increase payoffs to subordinate lien holders who agree to release borrowers from debt to facilitate greater use of foreclosure alternatives including short sales or deeds-in-lieu.For 1st lien principal reduction, the incentive from the Federal Government (taxpayers) is to pay 15 cents on the dollar for reductions in the unpaid principal balance for LTVs (loan-to-values) between 115% and 140%. For LTVs above 140%, the payment is 10 cents on the dollar, and for reductions below 115%, the payment increases to 21 cents on the dollar.The new payoff schedule allows servicers to increase the maximum payoff to subordinate lien holders to 6 percent of the outstanding loan balance and doubles from $1,000 to $2,000 the incentive reimbursement that is available to investors for subordinate lien payoffs, subject to an overall cap of $6,000.

The Treasury has some examples here for the various changes.

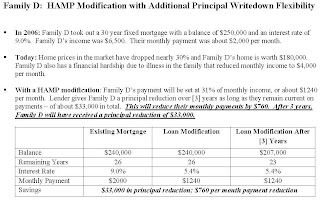

An example of principal reduction (optional):

Click on example for larger image in new window.

Click on example for larger image in new window.So this is 133% LTV. So the taxpayers will pay 15 cents on the dollar to the lender to reduce the principal by $33,000. This is a payment of $4,950 (the lender takes a loss of $28,050). This still leave the borrower with a LTV of 115%.