by Calculated Risk on 3/31/2010 08:55:00 AM

Wednesday, March 31, 2010

MBA: Mortgage Applications Increase

The MBA reports: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 1.3 percent on a seasonally adjusted basis from one week earlier. ...

“Purchase applications have increased over the past month, and are now at their highest level since last October when many homebuyers were rushing to get loans closed before the expected expiration of the homebuyer tax credit,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “We may be seeing a similar pattern now, as the extended version of the tax credit ends next month.”

The Refinance Index decreased 1.3 percent from the previous week and the seasonally adjusted Purchase Index increased 6.8 percent from one week earlier. This is the highest Purchase Index since the week ending October 30, 2009. ...

The refinance share of mortgage activity decreased to 63.2 percent of total applications from 65.0 percent the previous week. This is the lowest refinance share recorded in the survey since the week ending October 23, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.04 percent from 5.01 percent, with points increasing to 1.07 from 0.76 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

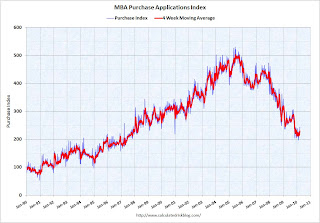

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The recent uptick in purchase applications is probably related to buyers trying to beat the expiration of the tax credit.

I've heard from some real estate agents that activity seems to have picked up, more than the normal seasonal increase, and the MBA data would seem to suggest this is happening. However I expect any increase in activity this year to be less than the increase last year.