by Calculated Risk on 3/17/2010 11:59:00 PM

Wednesday, March 17, 2010

Previous Business Cycle: "Bad by any measure"

We've seen all the statistics from the aughts - declining employment, declining stock prices, and weak income.

Andrew Flowers, economic research analyst at the Atlanta Fed, points out that decades are arbitrary, and that the previous decade started with a recession and ended with the great recession. He suggests looking at periods as trough-to-trough: Bad by any measure

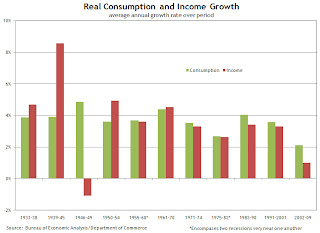

Flowers provides graphs of GDP, personal income and consumption, and payrolls for each trough-to-trough period. As an example, on income and consumption: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Flowers writes:

[F]or real consumption and income growth, the 2002–09 period is also bleak. Average annual consumption and income growth had averaged 3.81 percent and 3.79 percent, respectively, going into 2002. But during this recent trough-to-trough period, income growth was very weak at 1 percent, with only the 1946–49 period doing worse (–1.09 percent). But consumption growth in 2002–09 was the lowest on record, averaging only 2.12 percent growth annually.The 1946-49 period isn't surprising since there was a flood of workers from the military (keeping income down), but people had significant savings from WWII when income far outpaced consumption. Of course, in the recent period, consumption was higher than income primarily because of mortgage equity extraction (The Home ATM).

Another interesting observation is the spread between average annual consumption and income growth. The 1946–49 and 2002–09 periods are where it's the largest, at 5.9 percent and 1.1 percent, respectively. These large imbalances could possibly reflect growth in household debt and/or lower saving rates, as consumption growth far outstrips income growth. Indeed, debt grew and savings declined notably during 2002–09.

The previous business cycle was "bad by any measure".