by Calculated Risk on 4/04/2010 12:25:00 PM

Sunday, April 04, 2010

Weekly Summary and a Look Ahead

The economic news will be a little lighter in the up coming week, although there will be a number of Fed speeches.

Early in the week, I expect REIS to release the Q1 vacancy data for offices, malls and apartments. This is key data for commercial real estate, and the vacancy rates have been steadily rising and setting new records.

Later in the week, we will probably get the March National Federation of Independent Business (NFIB) small business survey and the rail traffic report for March from the Association of American Railroads (AAR).

On Monday, the ISM non-manufacturing (service) index for March will be released at 10 AM ET, and February pending home sales from the National Association of Realtors (also at 10 AM). The consensus is for an increase in the ISM index to 54.0 from 53.0 in February, and a slight decline in pending home sales.

On Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for February will be released at 10 AM by the BLS. This report has been showing very little hiring and turnover in the labor market. Also on Tuesday the FOMC minutes for the March meeting will be released at 2 PM. Minnesota Fed President Narayana Kocherlakota speaks at 1 PM.

On Wednesday consumer credit will be released by the Federal Reserve at 2 PM. Fed Chairman Ben Bernanke is speaking at a luncheon, and also on Wednesday Kansas City Fed President (and inflation hawk) Tom Hoenig speaks at 2PM.

On Thursday the closely watched initial weekly unemployment claims will be released. The consensus is for some slight improvement from the 439K last week. Fed Vice Chairman Donald Kohn speaks on the U.S. economic outlook at 4 PM, and Chairman Bernanke speaks on economic policy at 8:30 PM.

And on Friday, Wholesale inventories for February will be released at 10 AM. Also on Friday the FDIC will probably close several more banks. Puerto Rico is still on the clock ...

And a (long) summary of last week:

Click on graph for larger image.

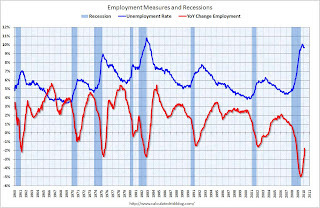

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 162,000 in March. The economy has lost 2.3 million jobs over the last year, and 8.2 million jobs since the beginning of the current employment recession.

The unemployment rate was steady at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 48,000 (NSA) in March. So payrolls increased 114,000 ex-Census.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.The Employment-Population ratio ticked up slightly to 58.6% in March, after plunging since the start of the recession. This is about the same level as in 1983.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate increased slightly to 64.9% (the percentage of the working age population in the labor force). This is at the level of the early 80s. Many of these people will return to the labor force when the employment picture improves - and that will keep the unemployment rate elevated unless net hiring picks up dramatically.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million. The all time record of 9.2 million was set in October. This suggests the increase last month was not weather related - and is not a good sign.

The next graph shows long term unemployment.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.55 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.3% of the civilian workforce. (note: records started in 1948)

Although the headline number of 162,000 payroll jobs was a positive (this is 114,000 after adjusting for Census 2010 hires), the underlying details were mixed. The positives: the unemployment rate was steady, the employment-population ratio ticked up slightly (after plunging sharply), the diffusion index showed more industries hiring, and average hours increased (might have been impacted by the snow in February).

But a near record number of part time workers (for economic reasons), a record number of unemployed for more than 26 weeks, and a decline in average hourly wages are all negatives.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Private residential construction spending is now 62.9% below the peak of early 2006.

Private non-residential construction spending is 29.0% below the peak of late 2008.

Residential spending will probably exceed non-residential spending later this year - mostly because of continued declines in non-residential spending as major projects are completed.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).This is a 13.9% increase from the February sales rate.

Excluding August '09 (Cash-for-clunkers), this is the highest level since September 2008. The current level of sales are very low, and are at about the low point for the '90/'91 recession (even with a larger population now).

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009.

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009."Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA).

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA).This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and down about 0.2% in January NSA (up 0.4% SA, but the data wasn't available when the charts were created).

The Composite 20 index is off 29.6% from the peak, and down about 0.4% in January (NSA) (up 0.3% SA)

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA.

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA. On a SA basis from the NY Times: U.S. Home Prices Prices Inch Up, but Troubles Remain

Twelve of the cities in the index went up in January from December. Los Angeles was the biggest gainer, up 1.7 percent. Chicago was the biggest loser, dropping 0.8 percent.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7.Here is the Philadelphia Fed state coincident index release for February.

In the past month, the indexes increased in 21 states, decreased in 22, and remained unchanged in seven for a one-month diffusion index of -2. Over the past three months, the indexes increased in 18 states, decreased in 25, and remained unchanged in seven for a three-month diffusion index of -14.

Best wishes to all.