by Calculated Risk on 5/10/2010 08:58:00 AM

Monday, May 10, 2010

Fannie Mae: $11.5 billion loss, sees no profits for "indefinite future"

For a EU / ECB summary, please see previous post: Euro Summary

From Fannie Mae:

Fannie Mae (FNM/NYSE) reported a net loss of $11.5 billion in the first quarter of 2010, compared with a net loss of $15.2 billion in the fourth quarter of 2009. Including $1.5 billion of dividends on our senior preferred stock held by the U.S. Department of Treasury, the net loss attributable to common stockholders was $13.1 billion ...Foreclosure activity is increasing:

We acquired 61,929 single-family real estate-owned properties through foreclosure in the first quarter of 2010, compared with 47,189 in the fourth quarter of 2009. As of March 31, 2010, our inventory of single-family real estate owned properties was 109,989, compared with 86,155 as of December 31, 2009.Greg Morcroft at MarketWatch reports:

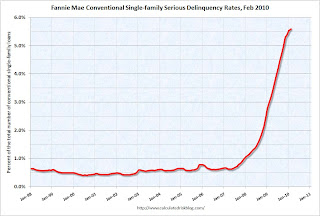

Fannie sees no profits for the "indefinite future" ... financial sustainability uncertain.Here is the monthly Fannie Mae seriously delinquent graph through February ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.59% in February, up from 5.52% in January - and up from 2.96% in February 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

It does appear the increases in the delinquency rate have slowed.