by Calculated Risk on 7/08/2010 02:16:00 PM

Thursday, July 08, 2010

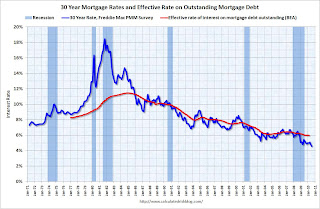

30 Year Mortgage Rates fall to Record Low

From Freddie Mac: 30-Year Fixed Rate Mortgage Drops Slightly to Create Another New Low

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.57 percent with an average 0.7 point for the week ending July 8, 2010, down from last week when it averaged 4.58 percent. Last year at this time, the 30-year FRM averaged 5.20 percent. This rate is yet another all-time low in Freddie Mac’s 39-year survey.

...

“With mortgage rates falling to historic lows, refinance activity has been strong over the past three months,” said Frank Nothaft, Freddie Mac vice president and chief economist. “The Bureau of Economic Analysis. reported that the effective mortgage rate of all loans outstanding was just below six percent in the first quarter of 2010, the lowest since the series began in 1977. Since the start of the second quarter, two out of three mortgage applications on average were for refinancing, according the Mortgage Bankers Association."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The red line is a quarterly estimate from the BEA of the effective rate of interest on all outstanding mortgages (Owner- and Tenant-occupied residential housing).

The effective rate on outstanding mortgages is at a series low of just under 6%, but the rate is moving down slowly since so many borrowers can't refinance because they do not qualify (either because the property value is too low or their incomes are insufficient).