by Calculated Risk on 8/19/2010 06:04:00 PM

Thursday, August 19, 2010

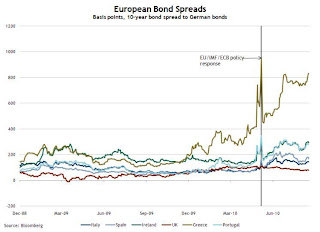

European Bond Spreads: Rising Again

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Aug 18th): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Peripheral European bond spreads over German bonds remain volatile and elevated.As of today, the Greece-to-German spread has widened to 834 bps (peaked at 963 bps in May) and the Ireland-to-German spread has increased to 293 bps (peaked at 306 bps in May).

Since August 9, the 10-year Greece-to-German bond spread has risen 93 basis points (bps) through August 17. Likewise, Portugal’s bond spreads rose 32 bps, Italy’s rose 16 bps, Spain’s rose 21 bps, and Ireland’s rose 42 bps during the same period.

The spreads are below the peak of the crisis in May, but above the level when the stress test results were released.

Note: The Atlanta Fed data is a couple days old. Nemo has links to the current data on the sidebar of his site.