by Calculated Risk on 9/29/2010 05:01:00 PM

Wednesday, September 29, 2010

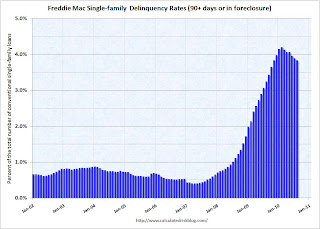

Fannie Mae and Freddie Mac: Serious Delinquent Rates decline

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 4.82% in July, down from 4.99% in June - and up from 4.17% in July 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

The second graph is for the delinquency rate for Freddie Mac. The rate declined to 3.83% in August (Freddie reports a month quicker than Fannie), from 3.89% in July.

The second graph is for the delinquency rate for Freddie Mac. The rate declined to 3.83% in August (Freddie reports a month quicker than Fannie), from 3.89% in July.

Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent.

More modifications have become permanent and no longer counted as delinquent, and Fannie Mae and Freddie Mac are foreclosing again (they have a record number of REOs) - so there has been a decline in the delinquency rate.