by Calculated Risk on 10/20/2010 10:49:00 AM

Wednesday, October 20, 2010

Wells Fargo on Foreclosures: "Procedures sound, no moratorium"

From Wells Fargo:

“With respect to recent industry-wide foreclosure issues, there are several important facts to know about Wells Fargo. Foreclosure is always a last resort, and we work hard to find other solutions through multiple discussions with customers over many months before proceeding to foreclosure. We are confident that our practices, procedures and documentation for both foreclosures and mortgage securitizations are sound and accurate. For these reasons, we did not, and have no plans to, initiate a moratorium on foreclosures."And a couple of pages from the Quarterly Supplement:

Click on slide for larger image in new window.

Click on slide for larger image in new window.Here is the slide from the Wells Fargo supplement. Not only are they arguing that their foreclosure process and procedures are "sound", but they argue that "Legal documents related to securitization properly transferred ownership".

However last week the Financial Times reported:

In a sworn deposition on March 9 seen by the FT, Xee Moua, identified in court documents as a vice-president of loan documentation for Wells, said she signed as many as 500 foreclosure-related papers a day on behalf of the bank.Note: I'm not analyzing Wells Fargo, just reporting on their comments.

Ms Moua ... said that the only information she verified was whether her name and title appeared correctly ... Asked whether she checked the accuracy of the principal and interest that Wells claimed the borrower owed – a crucial step in banks’ legal actions to repossess homes – Ms Moua said: “I do not.”

excerpt with permission

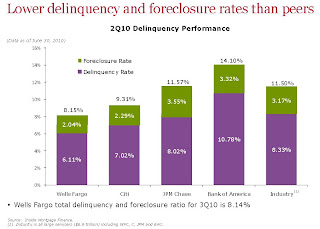

The next slide shows the delinquency and foreclosure rates for the large servicers.

The next slide shows the delinquency and foreclosure rates for the large servicers.BofA (Countrywide) and JPM Chase (WaMu) have the highest combined delinquency and foreclosure rates. BofA is the largest servicer with over 14 million loans ($2.2 trillion) at the end of Q2. Wells Fargo is second with about 12 million loans ($1.8 trillion), and JPM Chase is third with about 9.5 million loans ($1.35 trillion).