by Calculated Risk on 11/26/2010 07:34:00 PM

Friday, November 26, 2010

Fannie and Freddie on Foreclosed Homes: Resume all normal sales activity

From Kimberly Miller at the Palm Beach Post: Fannie Mae, Freddie Mac give the 'go-ahead' to resume sales of foreclosed homes

Fannie Mae and Freddie Mac gave the go-ahead this week to restart sales of their foreclosed properties ... Brokers received memos Wednesday from the government-sponsored enterprises saying that the homes could once again be marketed and sales finalized on properties already under contract.Fannie and Freddie halted some sales of already foreclosed properties (REO: Real Estate Owned), and they also halted some foreclosures in process. The above story was on sales of REOs.

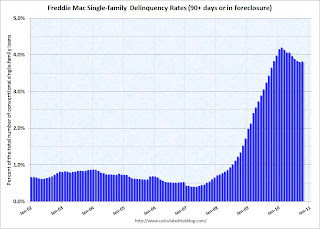

On a related point, Freddie Mac reported that the serious delinquency rate increased to 3.82% in October from 3.80% in September. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Click on graph for larger image in new window.

Click on graph for larger image in new window.Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increase in October - the first increase since February - is probably related to the new foreclosure moratoriums.

Note: Fannie and Freddie report REO inventory quarterly, but the FHA reported that REO increased sharply in October to 54,609 from 51,487 at the end of September. So even though Fannie and Freddie halted many foreclosures in process, they also halted REO sales - so my guess is their REO inventory probably increased in October and November too (like for the FHA).