by Calculated Risk on 12/02/2010 01:02:00 PM

Thursday, December 02, 2010

Employment Report Preview

The BLS will release the November Employment Report at 8:30 AM tomorrow. The consensus is for an increase of 145,000 payroll jobs in November, and for the unemployment rate to stay steady at 9.6%. Note: Bloomberg is listing the consensus as 168,000 payroll jobs, and an increase in the unemployment rate to 9.7%.

Most of the recent employment related reports have been slightly above expectations:

• ADP reported Private Employment increased by 93,000 in November, the largest gain in three years. This was well above expectations of 68,000 private sector jobs.

• The ISM manufacturing employment index decreased slightly to 57.5 from 57.7 in October. This still suggests some hiring in manufacturing (the ADP report showed manufacturing employment increased by 16,000 in November). Most of the regional Fed manufacturing surveys also showed an increase in employment in November.

• Weekly initial unemployment claims were down significantly from October.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The average over the last 4 weeks was 431,000 initial claims per week.

For October the average was 456,500. Although still elevated, this suggests some pickup in hiring compared to October.

• The Reuters/University of Michigan consumer sentiment index increased to 71.6 from 67.7 in October.

• The Reuters/University of Michigan consumer sentiment index increased to 71.6 from 67.7 in October.

This graph shows the consumer sentiment index.

There is some correlation between consumer sentiment and employment, and although this increase in sentiment was minor (and sentiment is still low), this does suggest some improvement.

• As I mentioned last month, the decennial Census hiring and layoffs can be ignored. As of October, there were only 1 thousand temporary census workers remaining on the payroll.

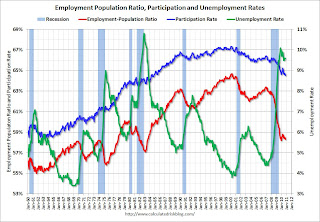

• The unemployment rate is dependent on both job creation and the participation rate.

Usually the participation rate - the percent of the civilian population in the labor force - falls when the job market is weak. And a decline in the participation rate puts downward pressure on the unemployment rate (and the opposite is true when the participation rate increases).

Right now the participation rate is very low at 64.5%, and a further decline would be considered very bad employment news (even if the unemployment rate declined slightly). An increase in the participation rate (due to more confidence), could lead to an increase in the unemployment rate even as hiring improves.

This graph shows the recent sharp decline in the participation rate (blue), and also the unemployment rate and the employment-population ratio. The participation rate had mostly been above 66% since the late '80s, and had been over 67% in the late '90s.

This graph shows the recent sharp decline in the participation rate (blue), and also the unemployment rate and the employment-population ratio. The participation rate had mostly been above 66% since the late '80s, and had been over 67% in the late '90s.

The participation rate probably increased in November, and this might have pushed the unemployment rate up to 9.7%.

For much more on the participation rate, see:

• Labor Force Participation Rate: What will happen?

• Labor Force Participation Trends, Over 55 Age Groups

Note: I think the participation rate will move back towards 66% over the next few years, even with an aging population.

• In October the seasonally adjusted unemployment rate was 9.644% unrounded (reported as 9.6%), so it won't take much of an increase to reach 9.7% for November.

• Bottom line: I think hiring improved in November (I'll take the over again on jobs), but the unemployment rate might have increased too (depending on the participation rate).