by Calculated Risk on 12/19/2010 09:20:00 AM

Sunday, December 19, 2010

Summary for Week ending December 18th

Note: here is the economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs. A key story was that the proposed tax legislation was passed by the Senate and House, and was signed into law on Friday.

• Housing Starts increased slightly in November

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

Total housing starts were at 555 thousand (SAAR) in November, up 3.9% from the revised October rate of 534 thousand, and up 16% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

This was close to expectations of 550 thousand starts. The low level of starts is good news for housing, and I expect Starts to stay low until more of the excess inventory of existing homes is absorbed.

• Industrial Production, Capacity Utilization increased in November

This graph shows Capacity Utilization. "The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009." This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. "The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009." This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.

This was slightly above consensus expectations of a 0.3% increase in Industrial Production, and an increase to 75.0% for Capacity Utilization.

• Retail Sales increased 0.8% in November

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 12.8% from the bottom, and only off 0.3% from the pre-recession peak.

This was above expectations for a 0.6% increase (and October was revised up). Retail sales ex-autos were up 1.2%, above expectations of a 0.6% increase.

• CoreLogic: House Prices declined 1.9% in October

CoreLogic reported house prices declined 1.9% in October. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

CoreLogic reported house prices declined 1.9% in October. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 3.93% over the last year, and off 30.2% from the peak.

The index is 2.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

• NFIB: Small Business optimism improved in November

This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in October (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in October (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

• CoreLogic: 10.8 Million U.S. Properties with Negative Equity in Q3

Note that the slight decline in homeowners with negative equity was mostly due to foreclosures.

First American CoreLogic released the Q3 2010 negative equity report this week.

CoreLogic reports that 10.8 million, or 22.5 percent, of all residential properties with mortgages were in negative equity at the end of the third quarter of 2010, down from 11.0 million and 23 percent in the second quarter. This is due primarily to foreclosures of severely negative equity properties rather than an increase in home values.Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home. About 10% of homeowners with mortgages have more than 25% negative equity - although the percent of homeowners with severe negative equity has been declining over the last few quarters mostly because of homes lost to foreclosure.

The second graph shows the break down of equity by state.

The second graph shows the break down of equity by state.In Nevada very few homeowners with mortgages have any equity, whereas in New York almost half have over 50%.

As CoreLogic's Mark Fleming noted, the number of homeowners with negative might increase over the next few quarters with declining home prices.

• NAHB Builder Confidence Flat in December

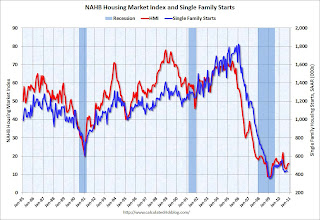

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (graph before November housing starts were released).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

• Other Economic Stories ...

• From the NY Times: Moody’s Slashes Ireland’s Credit Rating

• Here come the '99ers

• Unofficial Problem Bank list increases to 920 Institutions

Best wishes to all!