by Calculated Risk on 1/20/2011 02:31:00 PM

Thursday, January 20, 2011

Comments on the Philly Fed Survey

Just getting back to this ...

From the Philly Fed: January 2011 Business Outlook Survey

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged down slightly from a revised reading of 20.8 in December to 19.3 in January. [anything above 0 shows expansion]That is all good news. The concern is the pickup in both prices paid and received:

...

The new orders index increased 13 points this month, the fourth consecutive monthly increase.

...

The current employment index increased 13 points [to 17.6], and for the fifth consecutive month, the percentage of firms reporting an increase in employment (25 percent) is higher than the percentage reporting a decline (7 percent).

Price increases for inputs as well as firms' own manufactured goods are more widespread this month. Fifty-four percent of the firms reported higher prices for inputs, compared with 52 percent in the previous month. ... More firms reported increases in prices (26 percent) than reported decreases (9 percent), and the prices received index increased 8 points, its second consecutive positive reading.

Click on graph for larger image in new window.

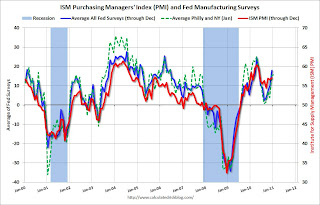

Click on graph for larger image in new window.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

This early reading suggests the ISM index will be in the high 50s again this month.

Overall the Philly Fed survey was positive.