by Calculated Risk on 1/25/2011 12:26:00 PM

Tuesday, January 25, 2011

House Prices and Months-of-Supply, and Real House Prices

This morning S&P/Case-Shiller released the monthly Home Price indexes for November (a three month average). Here is a look at house prices and existing home months-of-supply, and also real house prices (2nd graph).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

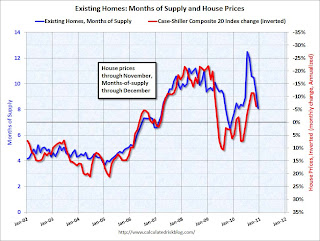

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through November using the composite 20 index. Months-of-supply is through December. Based on this general relationship, I expect house prices to fall further.

The months-of-supply declined to 8.1 months in December, but I think there is a good chance that the months-of-supply will increase again in the spring of 2011. The months-of-supply uses the seasonally adjusted sales rate, but the not seasonally adjusted inventory - even though there is a clear seasonal pattern for inventory (low in December and January and higher during the summer).

We will need to watch inventory and months-of-supply very closely over the next few months for hints about house prices.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

A few key points:

• The real price indexes are at post-bubble lows. Those who argued prices bottomed some time ago are already wrong in real terms, and will probably be wrong in nominal terms soon.

• Don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• Prices will probably fall some more and my forecast is for a decline of 5% to 10% from the October 2010 levels for the national price indexes. We will need to watch inventory (and months-of-supply) closely over the next few months to forecast house prices.